charitable gift annuity calculator

A Charitable Remainder Unitrust CRUT pays out a fixed percentage of the trust value each year. You get a tax break for your charitable gifts if you donate to a qualifying organization and itemize your deductions.

Consumer Report Gift Annuity Calculator

Qualified Charitable Distributions from your traditional IRA are a way to take your RMD without having to report it as income and paying the requisite taxes.

. Any relevant capital gains will be taxed at the current owners tax bracket. The gift tax imposes a tax on large gifts preventing large transfers of wealth without any tax implications. Indexed annuities perform well when the financial markets perform well.

Youll be presented with options regarding premiums payout schedules investment types add-on features and death benefits. Eligible amount is the. View annuity rates for single life annuities joint life annuities term certain annuities indexed annuities deferred annuities impaired annuities and previous annuity rates from 2021 to 2011.

Bring your ministry vision to life with a loan from WatersEdge. And should the gift occur prior to the annuity owners age of 59 ½ the transaction will be subject to a 10 IRS early withdrawal penalty. View the 2022 RRIF minimum withdrawal table.

They are a gathering of dynamically gifted individuals with a passion to help families develop. The amount will be recalculated each year and the Lead Beneficiaries receive larger payments that year if the CRUTs rate of return exceeds the fixed percentage payout and smaller payments that year if the CRUTs rate of return is less than the fixed percentage payout. Property you receive as a gift bequest or inheritance isnt included in your income.

Preferable tax treatment hedge your longevity risk and fulfill your calling to give back to the world all at once. By definition a charitable. 2021 free Québec income tax calculator to quickly estimate your provincial taxes.

WaterStone is the home of practical day to day helpsolutions for families and professional planners providing cutting edge creative charitable tools. Compare Annuity Benefits Not Annuity Features When we talk about all the different types of annuities were referring to the available features. The 2022 RRIF minimum withdrawal rates.

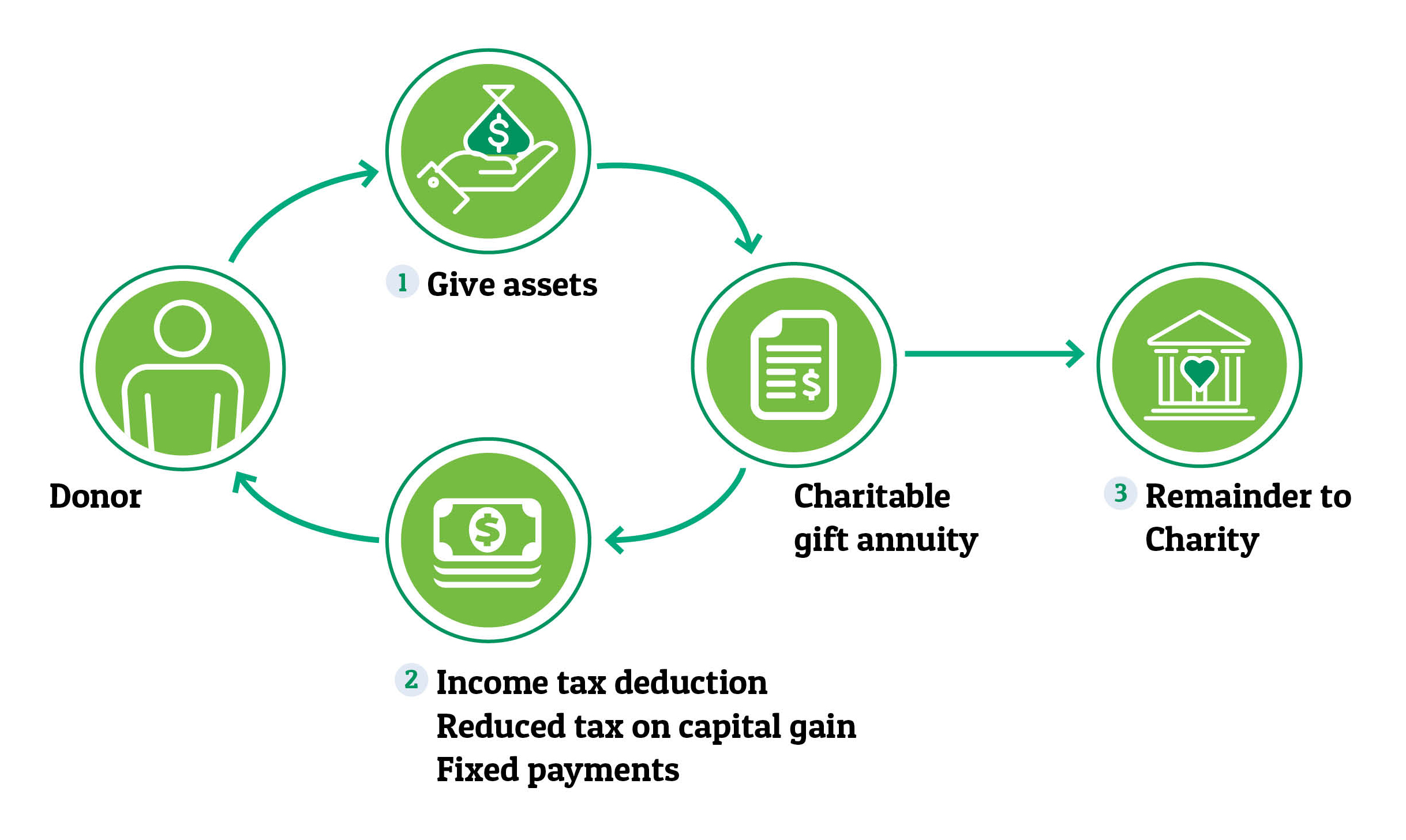

In exchange the charity assumes a legal obligation to provide you and up to 1 additional beneficiary with a fixed amount of monthly income that continues until the last beneficiary dies. If you make a single non-cash. With more than 30 years of experience in charitable gift services Ren supports charitable gift portfolios for over 140 institutions including large and small nonprofit organizations universities community foundations and financial firms.

The Taxpayer Certainty and Disaster Relief Act of 2020 waived this requirement in 2020 and the waiver still applies for tax year 2021. The size of the estate youd like to leave behind. Also known as the RRIF Payout Schedule by the Canada Revenue Agency CRA.

So QCDs reduce your Adjusted Gross Income AGI which generally provides a greater tax benefit than claiming the charitable contribution as a tax deduction and you dont need to. It is a transfer tax not an income tax. The IRS allows individuals to give away a specific amount of assets or property each year tax-free.

Save time and money by trusting WatersEdge with your churchs accounting needs. How to Claim Charitable Donations When You File Your Tax Return. Download The Guide If You Can Dream It We Can Finance It.

A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. Find the solution that fits your charitable goals with the Giving Solutions Guide. When an annuity is gifted to another party the transaction triggers a taxable event for the donor.

Canadian best comparison annuity rates service. You can claim a tax credit based on the eligible amount of your gift to a CRA qualified donee. Certain interest expenses charitable contributions casualty and theft losses and certain.

Ordinary monetary and property gifts are. The benefits are three-fold. If your intent is to leave a gift to charity consider a charitable gift annuity instead.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2021. An indexed annuity also known as a fixed-index or equity-indexed annuity features income payments tied to a stock index such as the SP 500. In 2021 the annual gift tax exemption is 15000 meaning a person can give up 15000 to as.

Apply for a loan Ministry Finances Eating You Alive. During most tax years you are required to itemize your deductions to claim your charitable gifts and contributions. A Roth IRA is an individual retirement plan that can be either an account or an annuity and features nondeductible contributions and tax-free distributions.

Gift Calculator Give To The Uw

Charitable Gift Annuities Giving To Duke

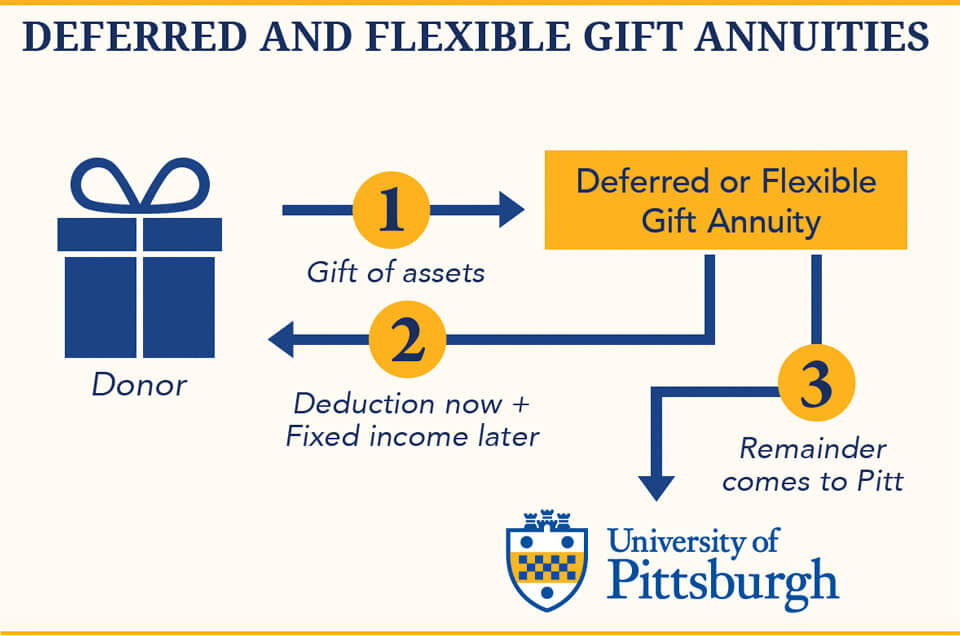

Charitable Gift Annuities The University Of Pittsburgh

Charitable Gift Annuity Focus On The Family

Charitable Gift Annuities National Wildlife Federation

Charitable Gift Annuities Uses Selling Regulations

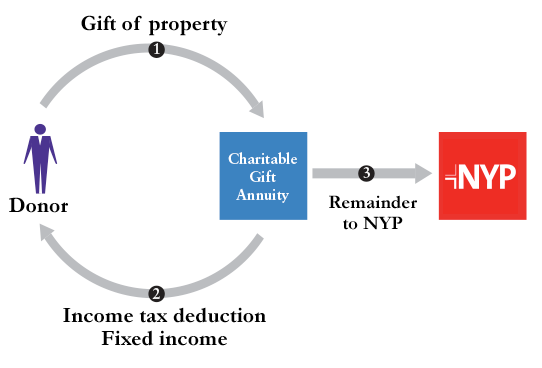

Nyp Giving Planned Giving Gifts That Provide Income Charitable Gift Annuity Nyp

Gifts That Pay You Income Union Of Concerned Scientists

Planned Giving National Park Foundation

Charitable Gift Annuities Gift Planning

Gifts That Pay You Income Girl Scouts Of The Usa

Charitable Gift Annuities Kqed

Planned Giving Calculator Harvard Alumni

Gift Calculator Harvard Medical School

Charitable Gift Annuities Giving To Duke

Charitable Gift Annuities University Of Montana Foundation University Of Montana